SBI SIP Calculator

Table of Contents

What is SIP?

SIP or Systematic Investment Plan is a disciplined approach of investing some amount on regular intervals in any mutual fund for certain time period in order to generate the wealth by using the power of compounding.

To start doing the sip you can compare different mutual funds on indmoney and select the best suited one for you.

SBI SIP Calculator – Mutual Fund Returns Calculator

Our SBI SIP Calculator is the best calculator to calculate the mutual fund SIP returns for long term.

As much doing an SIP investment is important, calculating your future returns is also important as your complete depend upon this corpus.

Thus, manually calculating this can be hectic and time consuming, thus we have designed this Sbi SIP calculator, that tells how much your final returns will be if you do an SIP in any mutual fund for certain investment period.

Today, our Mutual Fund industry has grown 6 times to Rs. 61.16 trillion in 2024 compared to Rs. 9.75 trillion in 2014, and in upcoming years it will be going to boom more rigorously, hence, you need a mutual fund returns calculator that can tell your exact returns of any mutual fund.

How To Use SBI SIP Calculator

To use our SIP Calculator :-

- Firstly, enter the initial investment amount from which you wanted to start your SIP in “Initial Investment Amount Column“.

- After that, enter how much money you wanted to invest monthly in form of SIP in “Monthly Contribution Column”.

- Enter how much you are expecting average annual return on your SIP, do remember to check the past 10 years of net return of any mutual fund you are investing in to know how much average annual return you can expect your SIP will generate over the years.

- Finally, enter the investment period in terms of “Years” for you wanted to do your SIP investment.

Result Display:

- Total Amount Invested: The total amount you have invested in the form of SIP.

- Total Return: The total return you got on that invested amount as per the expected average annual return.

- Final Amount After X Years: The total amount by adding total amount invested and total return.

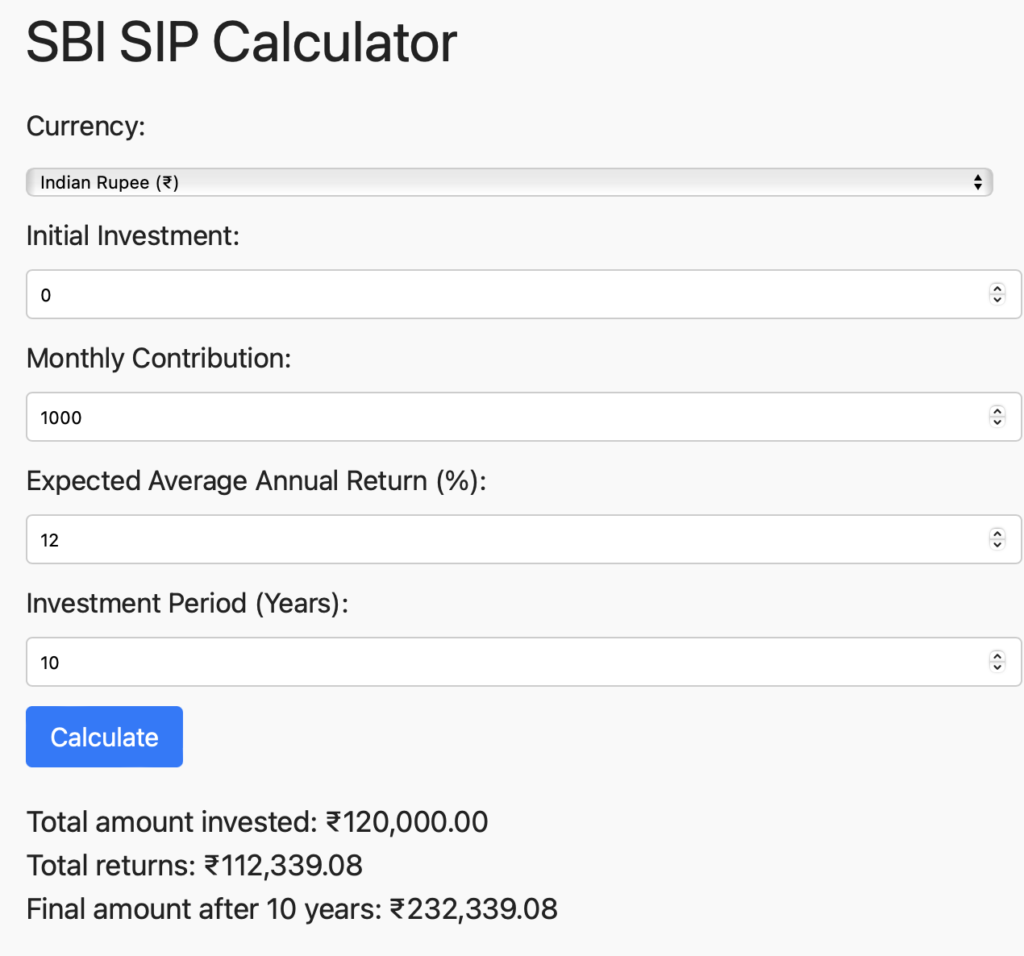

Example Calculation Using Our SIP Calculator

Let’s say you invest 1000 monthly with 0 initial investment in SBI Mutual fund that gives an expected annual average return of 12%.

Then how much returns you will accumulated after 10 years.

For this let’s put these number in our SIP Calculator.

- Monthly Contribution: ₹1,000

- Expected Annual Return: 12%

- Investment Period: 10 years

As you can check, from the results our sbi sip calculator has provided, your final returns after 10 years will be close to ₹232,339..

Benefits of SBI SIP Calculator

- Financial Planning – The sbi sip calculator helps to plan your future wealth corpus today so that you can not only retire early, but can also enjoy the wealth you build throughout the years.

- Time Saving – Our sip calculator will going to save your a lot of time that otherwise you will have wasted doing all the calculations manually.

- Easily Accessible – Unlike other sip caluclators, The Honest American SBI SIP Calculator is 100% free to use for everyone and can easily be accessed through our website.

Factors To Consider When Using SIP Calculators

- Unrealistic Expected Returns: Most of the investors use the sip calculators in a wrong by entering unrealistic expected annual returns, as per our historical returns NIFTY 50 has given 11-13% average annual return, while if you are investing in mid cap or small cap mutual funds you can expect 20-21% average annual return in long term.

- Neglecting Inflation: The final returns you see in the sip calculators never consider inflation that can erode your purchasing power. Thus, you must check the actual value of whatever final amount you are getting after x years inflation adjusted.

- Fees and Taxation – While our sbi sip calculator shows the final returns after x years, but that returns did not take the fees and taxation charged by mutual funds and government like expense ratio, exit load, long term capital gains tax, etc. into consideration.

- Investment Duration – SIP is always proven to provide best returns if you do it for a longer period of time. Thus, to see the power of SIP, you must invest for 20-30 years so that you will have a big wealth corpus at the time of retirement.

Final Words – SIP Calculator

Our SBI SIP Calculator is best tool to instant estimate your future returns of your mutual fund investments.

Taking the informed decision is very important especially when your future depends upon it, hence, calculating the SIP returns before starting it helps you to understand how much amount you should invest today every month to achieve your dream wealth corpus.

Disclaimer: The Honest American provides financial education, investing strategies, & stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.

Also checkout our other articles

10 thoughts on “Best SBI SIP Calculator – Instantly Estimate Your Mutual Fund Returns”