If you were just planning to invest in a SIP and suddenly you got to know that there is something called Step Up SIP also and Boom! you are confused!

Now what is this step up sip, how it is different from regular SIP, which one is more profitable, and much more.

Then be relaxed because here I will cover all these topics in the most easiest way for you to understand.

So, let’s get started.

SIP Calculator with Step-Up

Table of Contents

Introduction to SIP and Step Up SIP

SIP

SIP or Systematic Investment Plan is a disciplined way of investing some amount every month on a particular date of the month in any financial option, mostly a mutual fund.

Not only disciplined, but this is a passive approach too for building your wealth without actually getting involved in complex finance subjects and stock market.

You just let the compounding work for a long period of time to see the magic of SIP.

Step Up SIP

Step Up SIP as a name suggest is one step ahead of regular SIP both in terms on investment and return.

It starts from the very next year of starting a SIP, and it basically mean that every year you decide to increase the investment by increasing some amount in term of percentage or rupee (dollar if you belong to some other country).

This way you are simply igniting the compound process that ultimately results into higher return.

Step Up SIP vs Regular SIP

To understand what is the actual difference between Step Up SIP and a regular monthly SIP.

Let's take an example and will see how the returns will vary in both the cases:-

Case 1: Regular Monthly SIP

You started a monthly SIP in a mutual fund where you decided to invest 5,000 every month for let's say next 5 years.

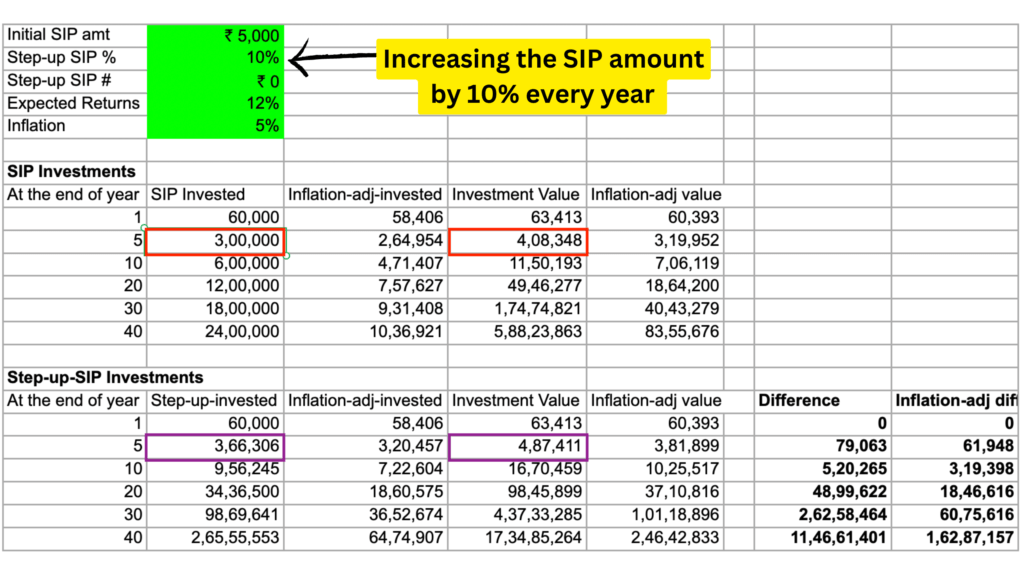

From above SIP calculator you can see the SIP Investments column and you will find that after 5 years you have totally invested ₹3,00,000 (3 Lakh) and your investment value will become ₹4,08,348 if you are getting a 12% average yearly return.

Case 2: Step Up SIP Calculator

Now in second case, in first year you thought that every month you will invest ₹5,000 and will increase this investment amount by 10% every year.

This way every month ₹5,000 will deduct from your account for complete 1 year or 12 months and after that the amount you are investing currently every month will automatically increase by 10% as per you decided initially.

Now from second year every month ₹5,500 (₹5,000 + 10% of ₹5,000) will start getting invested in form of SIP.

This way every year your investment amount will increase by 10% on the previous year monthly SIP.

Result and Benefits of Top-Up SIP

In this case also, if you get 12% average yearly return so you will find that due to opt for step up sip hence, in 5 years you will invest a total of ₹3,66,306 (see the purple box in Step-Up SIP invesment calculations)

And due to increase in your investment amount your return will also increase to ₹4,87,411 (a difference of ₹79,063 in Step Up SIP returns vs Regular SIP returns)

Although in 5 years this difference may look small but in longer time period like 30 years this difference will increase to ₹2,62,58,464 ( 2 crore 62 lakh 58 thousand)

How To Start A Step Up SIP Investment

To start investing in a step-up SIP first you need to open a demat account and have to verify your KYC. After your KYC has been verified, you can start investing in top-up SIP.

Do note today most big brokers in India like Zerodha, Upstox, Angel One, etc. , already started providing step-up SIP option for investing in their app itself.

To make you understand how you can start a step up sip, I am choosing the coin by Zerodha (the process is almost same for other brokers too)

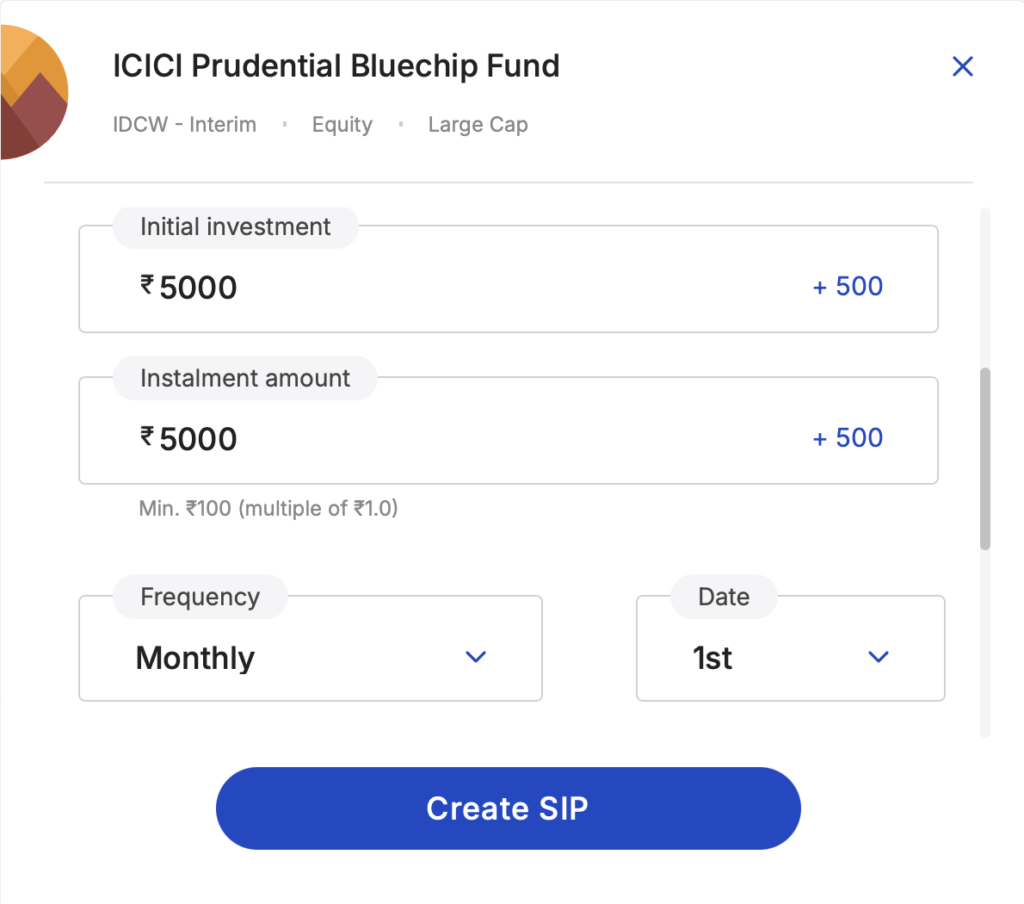

- Login your account in coin by Zerodha using your Zerodha login details.

- Choose any mutual fund in which you wanted to start a SIP.

- Write the amount you wanted to initially invest in this mutual fund and also choose the instalment or SIP amount that you wanted to invest every month in this mutual fund.

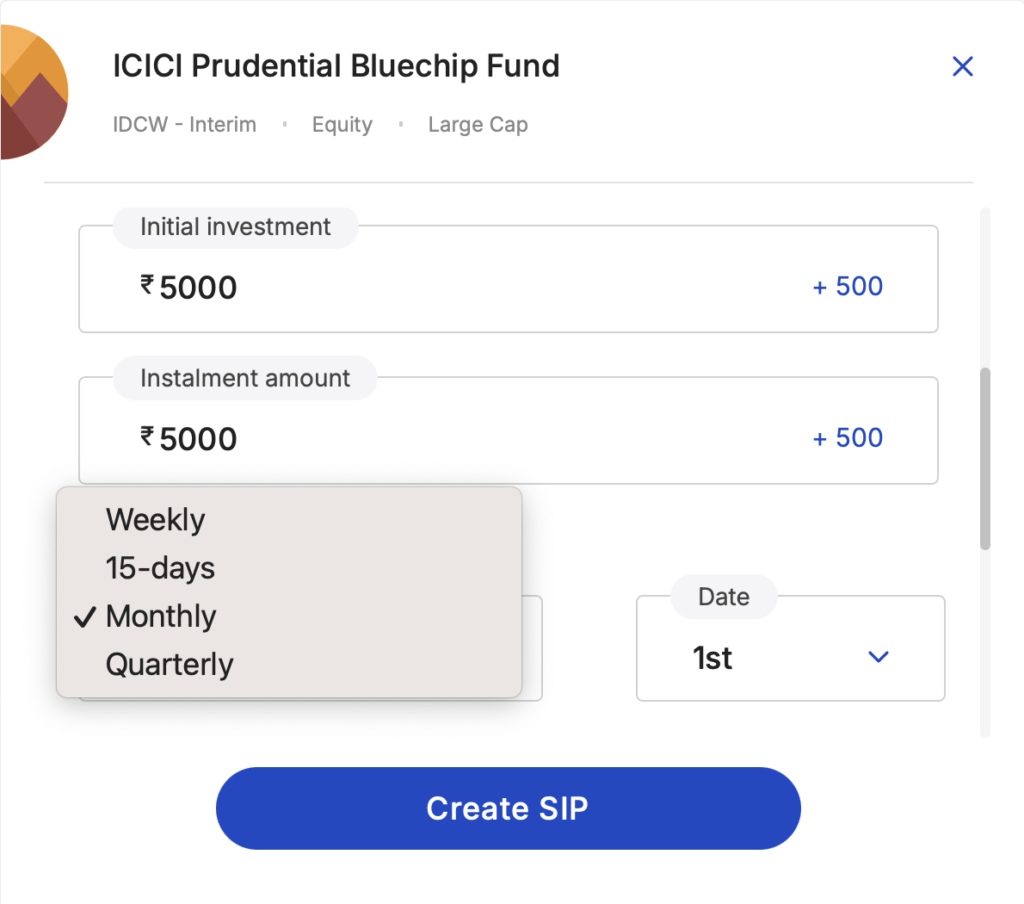

- Choose the frequency of investing, like weekly, monthly or quarterly, usually the monthly SIP is the best option.

- Choose the date of SIP on which you want the money automatically got debited from your account and get's invested in that mutual fund.

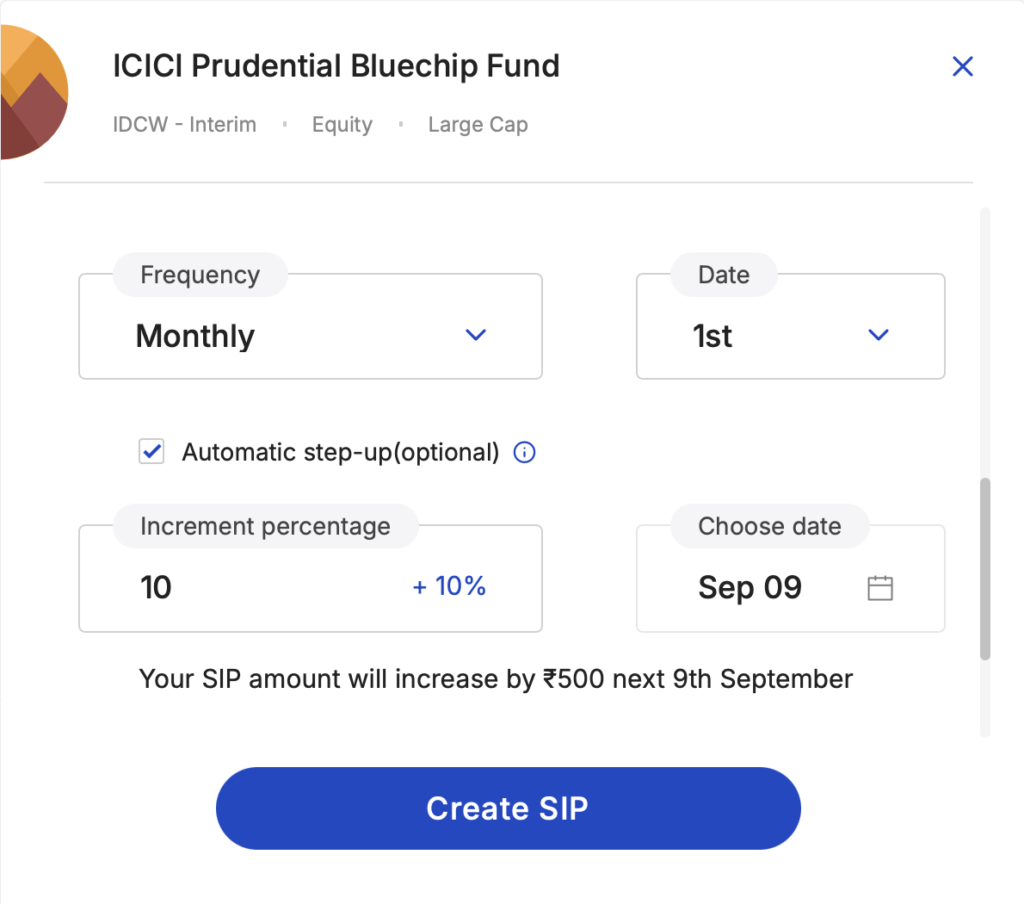

- Now, to convert this normal SIP into top up sip checkmark the box with the option Automatic step-up

- Finally, choose the increment percentage and step up SIP date of (by default it will be next year date) on which you want the amount you choose to invest will automatically increase by the increment percentage you just selected.

- Click on create SIP and you are all set.

If you wanted to modify, the current SIP into step-up SIP you can check here the complete instruction to modify the SIP.

Frequently Asked Questions

How to increase sip amount?

You can increase sip amount by choosing automatic step up option if you wanted to increase the amount once every year automatically while starting a new SIP or can even modify your ongoing sip to increase the sip amount manually.

Which is good daily sip vs monthly sip?

Daily SIP, can be bit hectic, time taking, also the final returns don't show much difference. Hence, we will recommend you to go for monthly sip and use automatic debit feature to build the wealth corpus passively in long term

How much percentage should I step up my sip?

We, recommend if you are young who just started earning, we will recommend that you don't increase the instalment more then by 10-15% because in longer the instalment amount will increase a lot due to compounding and that can create difficulty to keep going with your sip.

Final Words - Top-Up SIP vs Regular SIP

Building wealth with a small amount has become really easy and accessible to everyone today, thanks to SIP.

But investing through top-up sip takes you one step ahead in your wealth building journey.

As you know every year, in India we face at least 5% of inflation hence to keep up with the jones and to increase the compounding speed with this inflation or in order to beat the inflation, you should choose to increase instalment amount every year.

So that, you will have a large corpus even after it's inflation adjusted value.

Disclaimer: The Honest American provides stock market news and strategies for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.

4 thoughts on “Step Up SIP vs Regular SIP – Ultimate Comparison With Step Up SIP Calculator”