Today, we all talk about investing, doing a monthly SIP in mutual funds but rarely we talk about when we should withdraw our gains, after, we all are investing today to build a wealth corpus that we can enjoy later on.

That’s why today we are going SWP – Systematic Withdrawal Plan, what is the meaning, how it works, what are its benefits, taxation, and much more.

So let’s get started!

Table of Contents

SWP – Systematic Withdrawal Plan

SWP or Systematic Withdrawal Plan is a plan in simple terms where you invest a lumpsum amount in any financial option usually mutual fund in order to get some regular monthly income.

You can say, SWP is nothing but just opposite of a SIP. In SIP you invest monthly in instalments while in SWP you withdraw some money monthly in instalments again.

If you are getting retired and got your PPF and gratuity amount or sold a property and a big amount lying at your bank account that you wanted to invest and attain some regular income then SWP can be beneficial for you.

While the only condition here is either you invest a lumpsum amount today or do a SIP for some years like 8-10 at least, to build a big investment corpus that you can further invest in order to withdraw a regular income from it in form of systematic withdrawal plan.

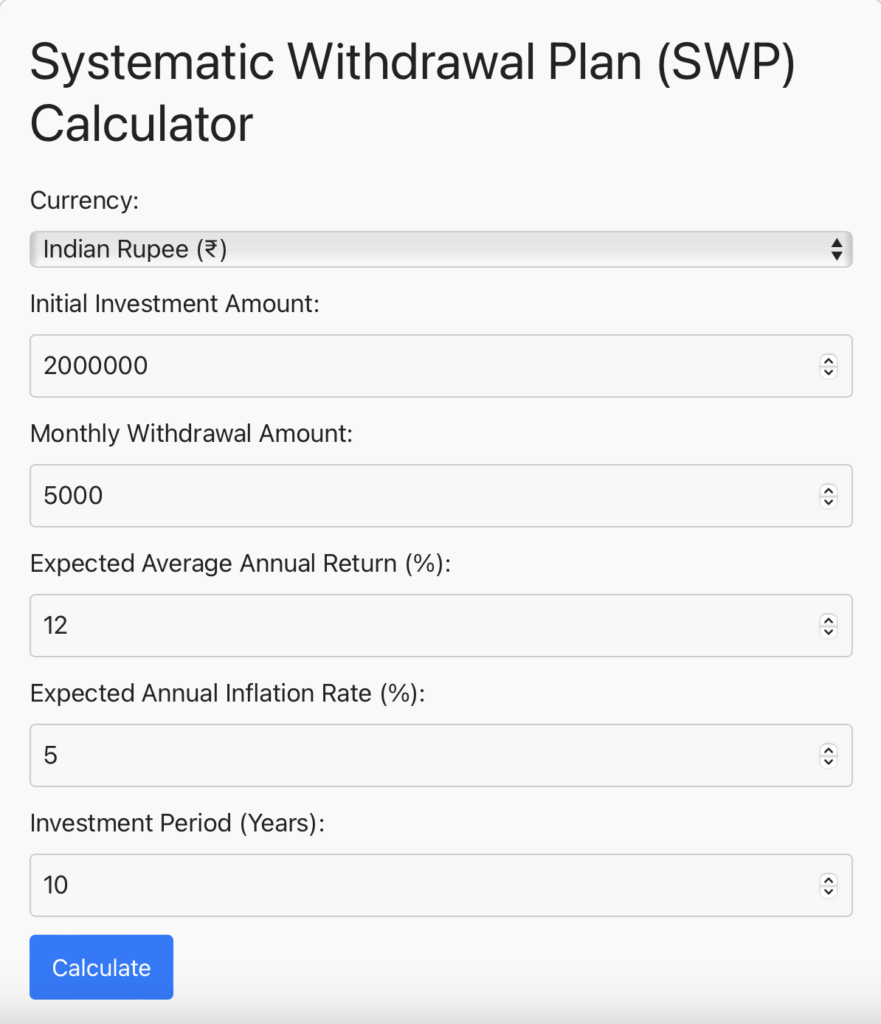

You can also calculate how much monthly income you can get inflation adjusted if you invest a lumpsum amount today using our SWP Calculator With Inflation.

How SWP Works?

Now you have an idea how a SWP (Systematic Withdrawal Plan) works theoretically, hence, let’s see a working with an example of SWP actually works.

For example:

Let say I invest ₹20 Lakh lumpsum and I wanted to withdraw ₹5,000 monthly but inflation adjusted (that means the amount I am withdrawing every month will increase as inflation increases).

With that I entered an expected average annual return as 12% and the expected annual inflation 5%.

Here I wanted to check that after 10 years of investment how much money total I have withdrawn and how much money is still left in my wealth corpus.

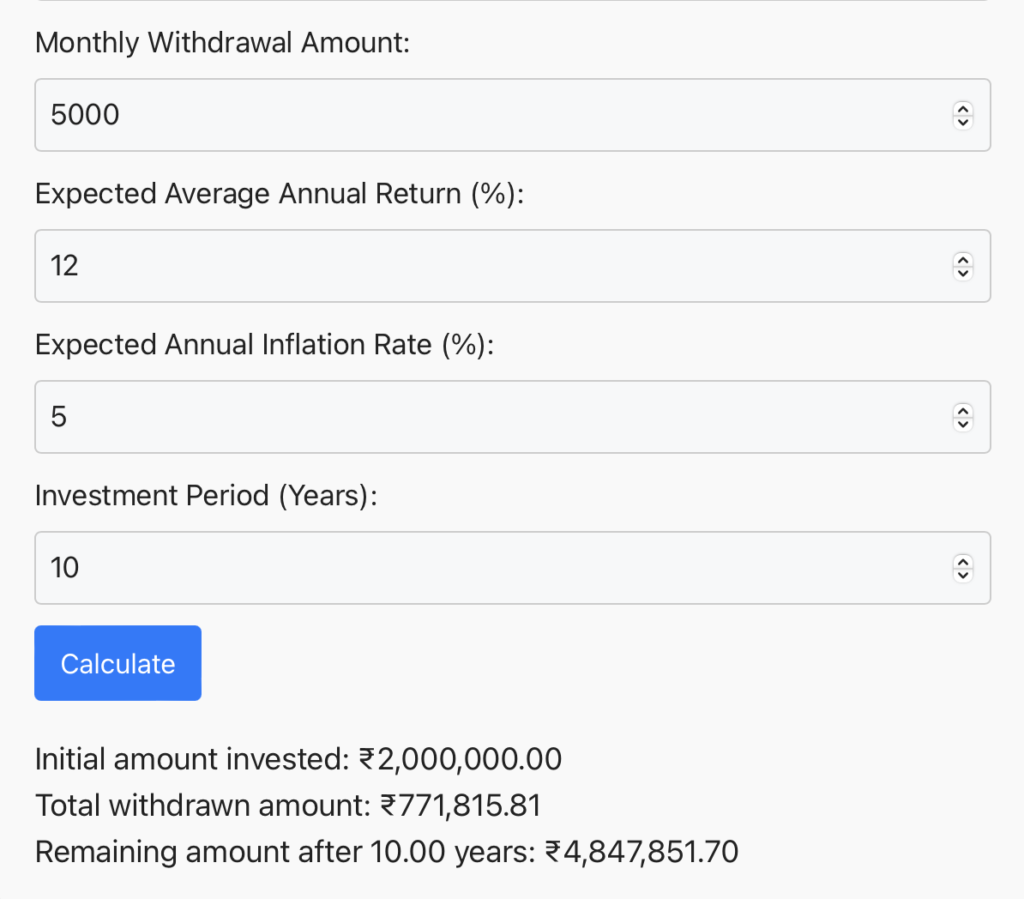

As you can check, from the calculations using our SWP Calculator, total I will withdraw ₹7,771815 in 10 years inflation adjusted and still I will ₹4,847,851 left in my wealth corpus.

Isn’t that amazing that although I was withdrawing some money every month, still my money got more than double in just 10 years.

But wait, isn’t this looking like a dream world, where everything is going amazing.

Well, it is!

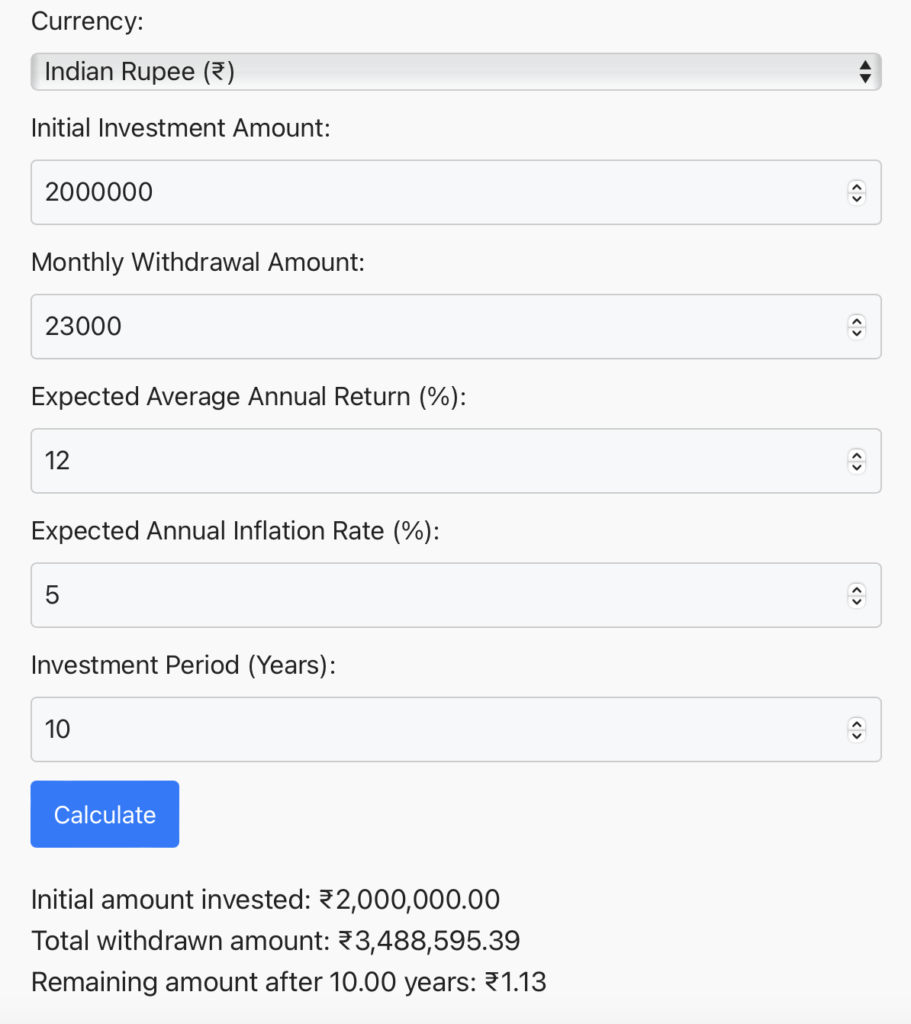

Let’s say now in this same example, instead of withdrawing ₹5,000 every if I withdraw ₹23,000 every month.

Then you can check after 10 year my complete wealth corpus or the lumpsum amount I had initially invested got eroded completely and I just left with ₹1.

Hence, now I hope you checked and understood how a SWP – Systematic Withdrawal Plan works and what’s the importance of choosing the right amount while withdrawing else after few years your investment gets completely vanished.

Benefits of SWP Plan

- Regular Income – The biggest advantage of a SWP plan is that you get a predictable regular income, that provides a certain relief especially if you are planning for retirement or already got retired.

- Passive Income Source – Investing in SWP Plan not only ensures that you get predictable regular income but also in a passive way as they do all the heavy task like where you have to invest, when to invest, etc. and you just enjoy the regular income.

- Flexibility – With A SWP or Systematic withdrawal plan you get the flexibility with your money. You can withdraw money as per you financial needs, even you can start or stop withdrawing the monthly income any time from it if you think that markets are currently falling and hence you wanted to delay withdrawing the regular monthly income.

- Taxation – Most people ignore this part, the money you withdraw monthly from your SWP Plan is taxed as per the mutual fund type you have invested. To know more about how these mutual funds are taxed you can check out our in depth article on mutual fund taxation.

- Rupee Cost Averaging – Both in SIP and SWP, the rupee cost averaging works perfectly due to which when markets are increasing then you have to sell less units of your mutual fund due to the high NAV and when they are decreasing you have to sell more units of your fund. Thus, they average out each other.

Best SWP Mutual Fund Plan For Monthly Income

Today, to start SWP or to invest in SWP you can directly invest in best mutual funds and can start opt for SWP so that automatically the certain unit of your mutual fund got sold every month and you keep on receiving the regular income.

Or now, some mutual fund companies started offering special SWP plan where you have to do a lumpsum investment and they provide a regular income while preserving your capital.

While here is the list of 5 Best SWP Plan For Monthly Income that you can consider:-

- ICICI Prudential Equity & Debt Fund Direct Growth

- Nippon India Large Cap Fund Direct Growth

- Motilal Oswal Midcap Fund Direct Growth

- JM Flexicap Fund Direct Growth

- Quant Small Cap Fund Direct Growth

Note – Do note all these SWP Plan have high risk because they majorly invest in equity markets and less in debt option due to which these funds are very volatile in nature and hence, provide high returns too.

While if you don’t wanted these high risk SWP plan then you can checkout fixed income mutual funds, they invest majorly in debt instrument hence, provide a fixed income and have a low risk due to low volatility.

Taxation on SWP Plan

When we talk about SWP, we usually discuss how much monthly income we can get but one thing most people forget to check that is you have to pay the taxes on the money you are withdrawing.

Yes, they are not tax free you have to pay the taxes on your SWP plan.

Taxation on SWP or Systematic Withdrawal Plan depends upon in which mutual funds you have invested your money.

Not only this you have to pay an exit load also in some mutual funds if you start withdrawing your money before a certain time period, hence it is always recommended to start withdrawing money after 1 Year of your investment because most mutual fund has exit load time period of max 1 year.

4% Rule For Systematic Withdrawal Plan (SWP)

The 4% Rule is a rule of thumb that suggests if you withdraw the max 4% of your total investment in a year using systematic withdrawal plan or SWP then your fund will never run out of money or your investment will never get eroded.

This way you can enjoy the regular monthly income for your complete lifetime and still you will have a huge amount lying in your corpus.

Don’t believe? Let’s see this with an example.

For Example:

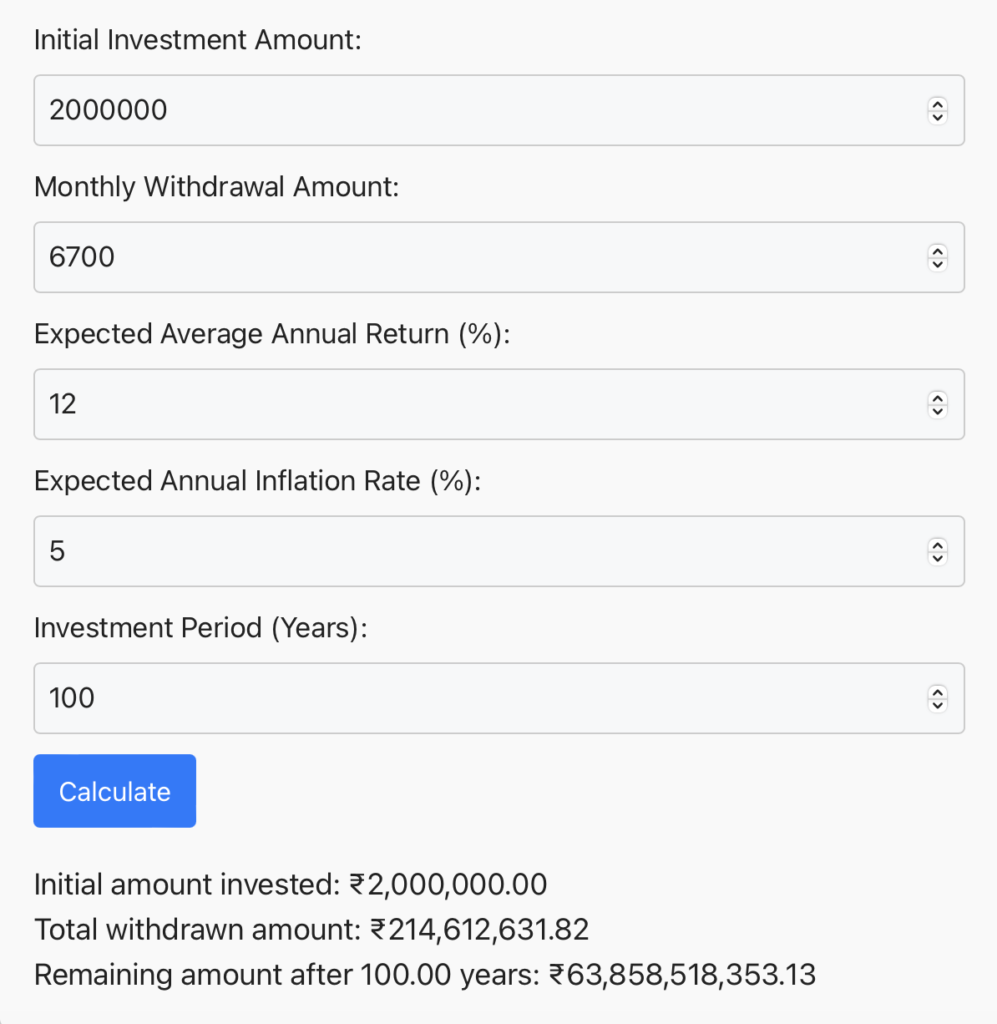

I am keeping everything same as of above example

Just changing the monthly withdrawal amount to 6700 which is around 4% of 20 Lakh that is 80,000 annually.

I have chosen the investment period as 100 years because 99.9% people will die before 100 years.

Now you can see if I just withdraw ₹6,700 that is 4% of ₹20 lakh (my lumpsum investment) then after 100 years I may have withdrawn total ₹21.46 crore and my wealth corpus may still have ₹6,385 crores.

Isn’t this mind boggling!

Frequently Asked Questions

SIP vs SWP – Which is better?

Well, both the SIP and SWP serves the different motives. In a SIP you invest some amount on a regular interval so that you can generate a big wealth corpus for your retirement, while SWP is meant for generating a monthly by investing a big lumpsum amount in one shot.

To know about the difference between SIP and SWP you can checkout our in depth guide on SIP vs SWP vs STP

What are the top performing swp mutual funds?

Well, you can do a SWP in any mutual fund, while I recommend to go with best performing large cap mutual funds and mid cap mutual funds as they are less risky then compared to small cap one.

Some of the top performing SWP mutual funds are:-

- Nippon India Large Cap Fund – Direct – Growth Plan

- Quant Mid Cap Fund Growth Option Direct Plan

- Quant Large and Mid Cap Fund Growth Option

What is SWP interest rate?

SWP is a way of investing your money to fulfil your motive of getting a monthly income from your investments. While do note that SWP are not a financial instrument like stock market, bonds, etc. hence SWP doesn’t have their own interest rate like a fd or PPF. SWP interest rate depends upon the returns of the underlying mutual fund.

Final Words – Systematic Withdrawal Plan (SWP)

We always plan to invest, but with we should also plan when and how we will withdraw our money and that’s the purpose of systematic withdrawal plan.

If you use this financial tool properly then your life not only become easy but you don’t have to depend upon others for your financial needs especially in the old age.

Disclaimer: The Honest American provides financial education, investing strategies, & stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.

Also checkout our other articles

1 thought on “SWP – Systematic Withdrawal Plan: Benefits, Taxation, Best Plan”